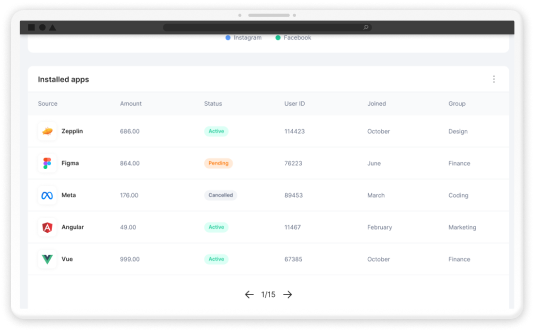

Search any City to Reveal its Real-Estate Risk Score

RE-VIX analyzes millions of real-estate signals, market pressure, liquidity strength, price velocity, and supply stress to show you where risk is rising or opportunity is emerging.

Who Uses the

RE-VIX Score

Trusted by real estate experts, financial analysts, and homebuyers seeking to identify safe opportunities, avoid high-risk markets, and make smarter decisions with volatility-based insights.

Increase Market Confidence With

RE-VIX Insights

Identify stable neighborhoods, spot rising risks early, and make smarter decisions with real-time volatility intelligence.

•Detect over-priced or unstable markets

•Compare volatility between cities or neighborhoods

•Predict price swings before they hit the news

•Avoid risky investment zones

•Validate property decisions with unbiased data

RE-VIX Methodology — Main Components

A data-driven scoring framework built on real-estate volatility science, market dynamics, and predictive analytics.